It’s glamorous, and the job will probably make you rich. That’s the immediate reaction many would have if they were offered a job to work directly for a billionaire or in the command centre of such a person’s family office.

The reality is often quite different.

I was reminded of this through a friend who is the author of a hilarious book about holding just such a job.

I recently had a drink with him in the sunny climes of San Diego. Inspired by our gathering of minds, I started to jot down some notes for an article I had long wanted to write.

- What do you need to consider before accepting such a job?

- Which tricky situations can you expect while on the job?

- What particular personal risks do you take by working for this kind of employer?

Here is the definitive list of points for negotiating your job working for a billionaire family office.

A few ground rules for this article

I was warned not to write this piece: “No one will hire you anymore.”

Luckily, I am not looking for employment.

Though even more importantly, this isn’t an article that aims to leave behind burned ground. Quite the opposite, its core aim is a positive one.

Working in such a unique environment can be incredibly rewarding and special. Provided, of course, you have chosen the position and its surrounding circumstances wisely.

My checklist is all about helping you make the right choices with such a job and avoiding those problems that no one would want to be exposed to. I have held one visible position in this sector, and managed various “special projects” behind the scenes as a freelancer over the course of nearly 25 years.

Looking back on my own experiences, I am not surprised that there are a few recurring structural problems in this sector. By now, I have heard about them from far too many people not to consider them somewhat endemic to this sector.

Ultimately, it’s in both sides’ interest that details of a prospective position are planned carefully in advance. Which is why I hope that even some family offices might find this list useful, however painful some of these realisations may be.

Working in such a unique environment can be incredibly rewarding and special. Provided, of course, you have chosen the position and its surrounding circumstances wisely.

Also, this “sector”, if there is one, needs to accept that it cannot exist in a bubble but is held to account just like everyone else. Being rich shouldn’t allow you to walk all over people, which is something that also happens way too frequently.

There are a few other points I’d like you to keep in mind before delving into the list:

- This article primarily refers to working directly for (and with) that wealthy individual and his/her family office, rather than entities that are funded by such a person or family office. Portfolio companies and other offshoots don’t count. It’s about working on the top level, i.e., very near the centre of wealth. That’s what I mean with my term “billionaire family office”.

- It’s aimed to be a guideline and to set out examples. Each situation is different and needs to be judged based on its own merits. A checklist on the Internet cannot ever be an all-encompassing overview of every imaginable aspect.

- I was able to base this checklist on the feedback of no fewer than four friends with real-life experience in this field. None of them will be named, nor will their principals. Trying to speculate which point might refer to whom is entirely futile.

- Many of the points below need to be considered jointly as they have some overlap.

With that in mind, please do consider the following ten points before your journey through the world of family offices.

Also, I wholeheartedly recommend the book that I name at the end and which helped inspire this article. Besides picking the brains of my friends, I also took a bit of inspiration from this particular story.

1. Low salary, high promises

Billionaire family offices often offer much lower salaries than corporate jobs, but they usually have some explicit or unspoken promise of more significant opportunities and potential riches further down the road.

In the vast majority of all cases, this will turn out to be a bad deal for you.

Working for or with rich people doesn’t make their wealth rub off on you. It can if there is a clear plan based on which this will happen. But that’s often not the case.

These opportunities and riches will never happen for a variety of reasons. This could be an unintentional consequence of some of the points below, or a system where a new generation of low-paid suckers gets hired each time the previous one is burned out. Or both.

Working for or with rich people doesn’t make their wealth rub off on you. It can if there is a clear plan based on which this will happen. But that’s often not the case.

More often, it’s a promise along the lines of: “Once we have achieved X, we will do something together.”

Because of their particular charisma and charm, it is often very, very hard to take a tough line in negotiations with these mega-wealthy individuals. You’ll find yourself sucked into their vortex and bedazzled by the energy. That’s how many low salaries get agreed. You believe their promises because making the world believe their promises is what made many of these people rich in the first place. They will probably be really good at convincing you that once X has been achieved, Y will appear in your wallet.

Subsequently, you’ll find that tomorrow never comes.

Also, keep in mind that glamour will not pay off your house or fund your retirement. Ultimately, your job HAS to be about earning you cash rather than pursue some dream.

Recommendation:

- We currently have an unprecedented war for talent. Any employer not willing to pay at least the market rate won’t attract top talent. There are too many alternatives elsewhere. Would you want to descend into a situation where, because of structural issues, you will never be surrounded by other top talents?

- If there is any plan “to do something together”, make sure it’s all negotiated and written down as part of the employment agreement. Never, ever trust any form of promise, even if you consider the principal a personal friend. Too many of these billionaire family offices know that if or when they break such promises, no one will ever hold them to account because they are too big and powerful an entity for an individual to take on.

2. Family members as colleagues

Billionaire family offices often employ “family members”, though the real-life meaning of this term is a bit broader. It will encompass:

- Actual family members.

- Close friends, i.e., quasi-family.

- People who can’t ever be laid off because they know too much.

The bottom line for you to consider is the following:

- You’ll be working with people who aren’t there for their talent. Often, those people serve as the principal’s on-demand Yes-Sayers and sycophants.

- You will always be lower in the hierarchy than them, no matter your job title and irrespective of how brazenly incompetent they are.

- Their presence leads to all sorts of ramifications, some of which will affect what you can achieve or get out of your job.

Here is a concrete example for you. Having just ONE single family member employed based on anything but their talent can destroy the dynamics of an entire team or family office. If one person gets away with delivering anything but their best competent effort, eventually, everyone else will lower their efforts accordingly. The quality of work and effort invested always ends up being based on the lowest denominator.

Keep in mind that it only takes ONE of those to poison the entire well.

That 42-year old niece of the principal who has never held a job for more than 12 months and only ended up in the family office because she is the family’s pity case, but gets to whisper into the principal’s ear – she will single-handedly destroy a lot of value in financial terms, make all hard-working employees’ life hell, and never be held accountable for it. Pleas to pay her a salary purely to stay at home and watch TV will fall on deaf ears. That one person will trigger a race to the bottom. Good luck with that work environment!

Keep in mind that it only takes ONE of those to poison the entire well. Often, there are multiple such people. Like London buses, they usually travel in pairs or triples. Once one family members gets admitted, the next ones queue up, hat in hand and openly wearing a sense of entitlement on their sleeve.

The possibilities for trouble are endless. Family members may deeply resent you if you bring actual talent to the table because it exposes their own incompetence. They might also treat you like a worthless plebeian, to make up for their own feeling of relative worthlessness.

Or even worse, if something terrible happens, you might get the blame to protect said family member. Try taking that case to court against an opponent with unlimited financial resources.

Obviously, there will be cases where family members are holding positions for entirely legitimate reasons. It can be hard to figure out in advance if that is the case, although I guarantee you that there will be enough cases where it’s entirely evident that it isn’t.

Recommendation:

- A billionaire family office with family members among their staff is probably the no. 1 warning sign that you should not work for them. Exceptions apply, but I would always expect the worst and make them evidence the opposite. If they aren’t willing to discuss this aspect or feel offended, you will have probably dodged a bullet.

This image shows “Ascariasis lumbricoides”, a parasitic roundworm. Many family members employed by billionaires are surprisingly similar to them.

3. Fake wealth

Many “billionaire” family offices sometimes just have a fraction of their alleged wealth.

Do not ever rely on “Rich Lists” published by newspapers and magazines. Many seem to have been researched by some 17-year old intern. Others are taking soft bribes, i.e., treating journalists well gets you a more favourable ranking on these lists. Many journalists are low-paid wage slaves with highly insecure jobs. A weekend trip, disguised as research, can go a long way.

Rich Lists usually come in three cases:

- Individuals whose wealth is overestimated (by a multiple).

- Individuals whose wealth is underestimated (often by a lot).

- Individuals who would deserve a place, but who actively managed to stay out of the public limelight altogether.

I’d stay clear off the first category but gravitate towards the latter two.

This point may or may not be relevant to you. Whether someone is worth 200 million or 1 billion may not make a difference for your situation within that firm. But it may do, if only because of the quality of staff such an operation can afford or the funds it can mobilise to carry out projects.

Recommendation:

- Is there reliable evidence for the wealth of your prospective employer? This could consist of regulatory disclosure notices about stakes in publicly listed companies or widely-reported news about the cash-sale of a privately held company. If it’s all somewhat opaque, then consider carefully if and how it could affect you.

You’d be surprised to learn the entire ugly truth about “Rich Lists”.

4. Work on dead-end pet projects

Many billionaire family offices pursue projects that are not entirely based on commercial reasons, but which are pet projects or acts of passion.

Honestly, if I had so much money, I’d do the same.

However, the question is, how will it affect your career if you end up working on one of them?

Something that is not commercially viable probably isn’t so for a reason. You, on the other hand, should want to work on something that has a clear plan leading to visible, verifiable success. Else, it’ll not be as strong a mark on your CV as it needs to be to see you advance in life. Providing pleasure and entertainment for a rich person is less impressive than building a new company and exiting it for a cash consideration.

With this point, too, there are different shades of grey. E.g., it may not even be a pet project of the principal, but a hopeless investment project proposed by a family member who whispered a “good idea” into the principal’s ear. Such a project might then be kept alive purely to save face.

Recommendation:

- Looking at the evidence and checking your gut feeling, will you work on a commercially sensible proposition or some kind of pet project? If the latter, consider carefully if this is the best career option for you. It may be, but do go into this situation with your eyes wide open. Also, if there is a promise of turning a pet project into a business, only give it credence if it is put into a formal agreement beforehand. “We’ll work this out later” does not count and is worth zilch.

5. Lack of further vocational training

I’ve said it before; there is a massive war for talent going on. Good people are more sought-after than ever before (as I have just realised even more when visiting some of the US West Coast’s best employers to chat with my friends there).

Equally, it means you are in a tougher competition than ever before if you want to get to or remain at the top. This probably means that you’ll regularly have to invest in your further job-related education.

Any employer worth its salt will make ongoing, systematic career advancement and additional training a part of their overall package. They will realise that doing so is the only way to attract the cream of the crop. They will offer it to you if they are intelligent. Good people don’t even have to ask.

Billionaire family offices often don’t have the necessary structures to deliver on this or even the awareness of this point. They only need to attract a relatively small number of people, which is why they don’t have much of an HR department (and they may struggle to attract a good HR person). They can live off the glamour of their name and the pulling power of their (purported) wealth. They will promise you that with the riches you will jointly create, you will be able to easily pay for your own further education.

Any employer worth its salt will make ongoing, systematic career advancement and additional training a part of their overall package.

All of this is inherently unsatisfactory. You’d probably want an employer that is on top of this issue as otherwise, you’ll end up working with colleagues who don’t fit into the top talent category.

Also, in a small organisation, there may not be the kind of positions available that would enable you to grow and move up the career ladder. Five or ten years pass quickly, and it may not look good on your CV if you spent the entire time in the same position. Much as you were impressed by working for John Doe the Billionaire, to many others, that name may not mean anything. Many of these rich folks like to think of themselves as widely-known celebrities when, in actuality, 99% of all people have never heard of them.

Recommendation:

- Will your prospective billionaire family office invest in your career advancement, and is this part of the formally signed package as well as the family office’s employment culture? If not, consider carefully what this will cost you in the long run.

6. Transferability of skill sets

Billionaire family offices can afford to hire you for particular, narrow tasks. There is nothing wrong with that, and it might suit your desires exceptionally well.

Do pay attention, though, how transferable and applicable these skills are once you have left this position.

The day will come when you will re-enter the real world. Being the principal’s favourite pet can be a real boost for your ego, but you might find yourself with too narrow a skill set to be of interest to anyone else.

Recommendation:

- In the definition of your future task before signing a contract (and during your annual reviews; if there even is one!), do always ask yourself critically if what you are doing will help you find an even better position once you move on. This is an excellent question to get some outside feedback on, e.g., from friends you trust or from former professional colleagues who can give you an honest assessment.

7. Losing your moral compass

The ultra-wealthy do have enormous privileges and power. You only need to open a newspaper to learn as much.

Some of them deal with this in the humblest of ways.

Others abuse it on an ongoing basis. E.g., famous are the words of hotel billionaire Leona Helmsley in a New York court: “Only little people pay taxes.” (She did go to prison in the end.)

As one of my friends who contributed to this article put it:

“You can easily lose your sense of reason, personal judgment and moral compass when you vicariously experience the power and privilege that ultra-wealth can provide.”

It is very tricky to know in advance which case you will be dealing with unless you already know the family office’s principal.

Recommendation:

- If you do not know anything about this ahead of signing your contract, do pay attention to it while you are on the job. Are you turning into a person that you would not like to see in the mirror? Don’t get drunk on being near such power and wealth. The hangover can be unpleasant.

Don’t let uber-wealth mess up your moral compass.

8. Ending up in legal difficulties

The following is a sub-aspect of the previous point, but it is so important that it deserves a separate mentioning.

Many billionaires feel they are above the law. Their dealings can drag you into legally questionable situations.

Do you risk breaking the law or being seen as part of a group that broke the law?

Might you even be at risk of getting blamed for something that the principal asked you to do or which you get the blame for so as to protect a family member?

Stranger things have happened.

Many billionaires feel they are above the law. Their dealings can drag you into legally questionable situations.

Today, this extends into a billionaire family office’s potential political position. In the era of “lawfare” (sic) applied in politics and government investigators looking to lure targets into committing so-called process crimes (such as perjury traps), you can unwittingly find your name in national media or court documents because of political tussles. If you have no idea what this paragraph refers to, then you are automatically at an increased risk of falling victim to all this.

Recommendation:

- In a large enterprise, you have “the system” protecting you from any legal trouble. In a billionaire family office, it can be the opposite. You might be the easy one to blame when something goes wrong. Be very, very mindful of these risks and never stray from the right side of laws and regulations. You don’t want to become a justice-involved person.

Getting into legal difficulties because of what she was asked to do as part of her job is not what she expected.

9. Losing the perspective of what counts in life

This point may be a bit on the philosophical side, but it’s worth mentioning.

When you work for a billionaire family office, your perspective about life and success can become highly warped.

You might start measuring yourself and other people with unrealistic standards, and inevitable feelings of inadequacy if you don’t live up to them. This can be coupled with the realisation that it’s a relatively meaningless and unfulfilling waste of time even to try. Working inside this kind of bubble, you are constantly subjected to an altered reality that is appealing and horrifying at the same time. You could lose sight of what is real and meaningful.

Recommendation:

- Self-reflect critically from time to time and ask a trusted friend (or two) for feedback on your job and how you as a person have evolved. Regularly spend time and keep friends outside of the bubble.

10. Deep, structural issues based on all of the above

Some of the points mentioned above apply to some billionaire family offices more so than to others. As with any organisation, there is an endless array of things that can go wrong. E.g., billionaire family offices often end up with more projects and investments than they can manage. You’ll then quickly find yourself having to handle five different jobs when you were hired for one – and are paid for one!

Virtually all organisations and companies are inherently screwed up in some way. Choosing an employer is always – always! – a question of picking your poison. You don’t want to end up in an organisation where specific issues can stand in the way of your career goals.

Recommendation:

Based on what I have observed and heard from friends, I would rate the sector of billionaire family offices as:

- Glamourous and fun, i.e., there is a lot in their favour.

- More often than not, too screwed up to be an attractive employer. In the war for talent, they are, on the whole, less likely to succeed. (Keep in mind that 90% of all fortunes are lost by the time of the third generation!)

- Best enjoyed in a small, short dose to “have done it once” before moving on as part of a bigger plan that you have developed for yourself. Make it one component of your CV, but don’t base your entire career on it.

As with everything in life, exceptions apply. Do not take my article as the gospel for anything, but as one of many resources that you need to take into account. Life always comes with different shades of grey.

A must-read book

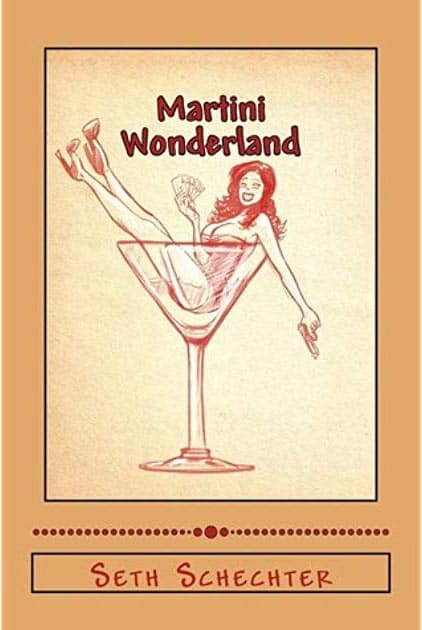

Available from Amazon or (even better) any real-world, high street book store.

“Martini Wonderland” is a remarkably useful book for anyone who is considering a job with a billionaire family office.

It is the story of Seth Schechter; a lawyer turned attaché to Sydney Frank, the inventor of “Grey Goose”. After selling his vodka brand to Martini for USD 2.5bn in cash within just seven years of founding the company, Frank created his own wonderland with a team of trusted aides, sycophants, hookers, and handlers. His subsequent dealings included federal agents, mobsters, and – as you’d expect by now – useless family members.

“Martini Wonderland” is a fabulous insight into the stranger part of billionaire family offices, but also a telling one about the realities of being involved with the world of the uber-wealthy.

Shortly before his death, Frank asked Schechter to write down his story – no-holds-barred!

It’s a book that made me laugh out loud on more than one instance. Unforgotten is the chapter about Frank’s professional sycophants having to clean diarrhoea out of his sneakers when he went about the daily soiling of his pants on the golf course. You get the idea.

“Martini Wonderland” is a fabulous insight into the stranger part of billionaire family offices, but also a telling one about the realities of being involved with the world of the uber-wealthy.

I read it in a single session, which is a rarity in this age of never-ending distractions. If there is a more informative book about the peculiar reality of working in the world of the uber-wealthy, then I have yet to find it.

A special thanks to the folks who contributed to this article – you know who you are!

If you enjoyed this article, then you might also like:

Want to print this article? Open a printer friendly version.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: