3.6 MILLION pound sterling.

If you are a professional living in the UK, that’s how much you can expect to pay in taxes during your life.

The figure is based on a a married person who starts with an annual salary of GBP 28,000 and, at age 50, reaches GBP 115,000. In London, such a level of income will put you in the comfortable middle class but certainly not any higher.

You don’t need to be a millionaire to end up paying multi-millions in taxes.

Let that sink in.

Don’t fool yourself that your situation was any better simply because you don’t live in the UK. In just about ANY other developed Western nation, the figures will be similar.

I am regularly amazed just how few people realise what their lifetime tax bill is likely to amount to.

Would you have known? When was the last time you tried to calculate this figure for yourself?

Also, have you ever tried to work out what you’re getting in return for all the money you contribute to the public purse? Is your government giving you a fair, reasonable deal? Does it put your money to good use?

I am regularly amazed just how few people realise what their lifetime tax bill is likely to amount to. Most people with a half-decent income can look forward to having several million taken away from them over the decades. Hardly anyone even seems to be asking the question, though. Many people moan, but they don’t work out the exact figures. Nor do they even think about potential alternatives. They accept such a level of taxation as the price they have to pay to live in a just society, but without ever looking at details.

Going forward, all of this will amount to a life-or-death question in a world where the younger generation will inherit trillions of debt, broken pension and healthcare systems, and not have the choice of high-earning jobs that their parents were able to choose from.

If you could cut your lifetime tax bill by GBP 1m and simply keep that money to yourself, would it be worth making changes in your life? What’s your price – does a million suffice or would it take two million to get you interested? How many years of earlier retirement could you afford with such money, and what would it do to your quality of life in terms of having more disposable income, feeling more secure, or being a better catch on the dating market? Would you want to contribute more money to good causes but decide for yourself where it goes and how it is spent? If you were able to buy another house (or two, or three) and generate rental income, what additional level of day-to-day freedom would that give you?

How much taxes you end up paying throughout your life is the single most significant determinant of your financial future. It’s not buying a house that is the most significant financial decision in your life, but how much taxes you accept paying.

I have LONG wanted to write an article about the subject of “lifetime tax bills”. I was shocked to see how little useful literature there is about this subject on the Internet. This article is a piece of passion and love. It can bring a lot of value to the people who take its information onboard. Ultimately, though, there are no answers that fit everyone and it’s all up to you to make it happen.

How much taxes you end up paying throughout your life is the single most significant determinant of your financial future.

To make it easier for you to digest the information and think about your situation, I decided to break it down into a three-part series.

Part 1: How do you estimate your lifetime tax bill?

I’ll show you how to do a rough calculation in a few minutes, or a more precise one if you are willing to invest an entire evening.

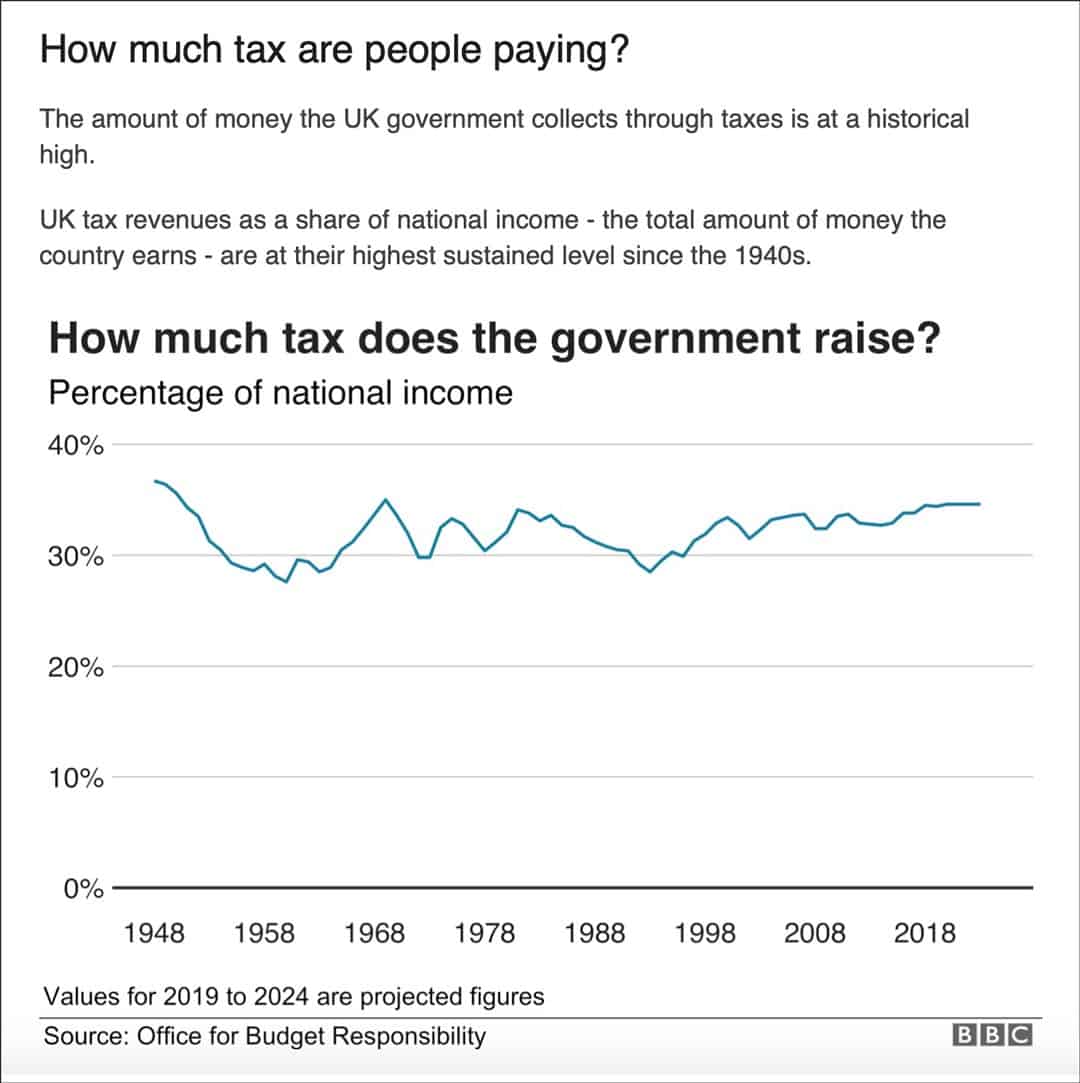

Part 2: How does your tax bill compare historically, and what will the future hold for you?

You need to understand history and a few headline numbers to put it all into context.

Part 3: What alternative lifestyles are available to you to cut your lifetime tax bill?

I will give you some advice on how to change your situation. In a first step, I will point you in three different broad directions of travel.

If you play your cards right, this series could be the single best investment of your time – ever.

3 critical aspects that will make your calculation relatively easy and reliable

I am a big believer in: “Done is better than perfect“.

The methods I am going to set out aren’t going to lead to a perfectly accurate result. Nor would any technique, ever. Given that you will have to estimate your income and factors such as how many years you are going to work, the calculation of your lifetime tax bill will never amount to more than a rough estimate.

But that’s good enough. Knowing the order of magnitude is all you need at this stage.

I first need to inform you about three contextual aspects. These are going to build the foundation on which your estimate stands, and they will make everything a lot clearer for you.

Here we go!

#1: Income tax is the easiest figure to work out, but…

It doesn’t take a lot of effort to figure out the taxes that are due on your income.

There are lots of online tools available to do that for you, such as this UK Tax Calculator 2020/21 offered by Moneysavingexpert.com.

Similar tools will be available online for just about any other country.

#2: …income tax is only half the equation!

The tax you pay on your income is what you can see instantly. You just need to check your payslip or annual tax return.

However, many other taxes will come out of your pocket every year of your life.

Some of the more prominent ones are:

- VAT (sales tax).

- Fuel tax.

- Alcohol tax.

- Airline ticket taxes.

- Car tax.

- Stamp duty (property transactions).

- Council tax.

- Dividend tax.

- Capital gains tax.

- National insurance schemes (as a form of tax).

- Inheritance tax (both when you inherit and when you die).

- 101 other hidden taxes that you didn’t even know existed.

The good news is, you don’t even need to research all of them. I will show you a shortcut that allows you to estimate your lifetime tax bill purely on the back of your income tax.

The one figure that you need to google for your country of residence is the following: what percentage does income tax contribute to the overall tax income of your government?

If you live in the UK, you can simply assume that your total tax is actually twice its officially published rate.

It is a figure that will be easy to research for most countries. There is a good chance you will find a ready-made percentage on the web. Alternatively, you need to research the amount of income tax collected and the total amount of taxes collected by your government, and then put them in relation to each other.

For the UK, the figure is 47%. Out of each pound of taxes collected by HM Treasury, 47 pence comes from income taxes and 53 pence from a gamut of other taxes.

HM Treasury collects twice as much in taxes altogether than it receives from income tax. If you live in the UK, you can simply assume that your total tax is actually twice its officially published rate. For most other countries in the Western industrialised world, the ratio is going to be similar.

Take it from the BBC.

#3: A small number of taxes makes up most of the overall tax income

If you take an active and more profound interest in the subject, you will not be satisfied with rough percentage estimates. You will want to create an overview that shows the different taxes that you pay on your various forms of income, and create a more granular calculation.

There are HUNDREDS of taxes in the UK. How to pull off such a calculation without wasting weeks of your time?

The good news is that you will be able to focus on around a dozen different forms of taxes. You can leave everything else aside as a rounding error.

Incidentally, the Daily Telegraph did such an exercise in 2016 and published the only genuinely informative article I found anywhere about the subject. The exemplary figures for a fictitious person I used for the introduction of this article are taken from the Daily Telegraph feature. The newspaper, in turn, based it on a person that it felt was representative of its readership.

The Daily Telegraph has published a useful model calculation.

How to create your estimate in 30 minutes or less – option #1

If you want to do a rough-and-ready estimate, this option is for you.

Create an estimate of what you are likely to earn over your career.

Look back at the income you started your career with, and then run an estimate of how your annual income is likely going to increase throughout your career and how long you intend to be working.

If you are still very young, you may find it an overwhelming challenge to estimate your future income. Worry not. Simply use the Average Salary section of LinkedIn to find some information about the average income of the career you would like to pursue.

Alternatively, you can simply rely on either of the following two proxies:

- If you are going to university and striving for a professional career, simply apply the figures of the example I am using. These are based on the average reader of the UK’s Daily Telegraph.

- If you feel that this assumption is too ambitious for yourself, look up the estimated lifetime tax bill published by the UK’s TaxPayers’ Alliance. Their figure is based on the average UK household, and they have summarised their findings in a short PDF. It’s from 2016, and they update it every few years. It won’t have changed much since they last provided an estimate.

If you do research your likely salary, creating a simple Excel sheet where you list your income and the income-related taxes for each year will be sufficient. For the amount of taxes on your income, refer back to the online calculator I showed you earlier.

As I have shown you, in the UK, income tax makes up 47% of national tax revenue. This means that for each GBP 1 of income tax you pay, you will pay another GBP 1 in other taxes.

In this case, you can simply double the amount of income tax that you pay across your lifetime. There is your lifetime tax bill!

In this example, you end up with an estimated GBP 3m.

How to create your detailed estimate in two to three hours – option #2

If you are not satisfied with such a back-of-the-envelope calculation, you should spend a bit of time on creating a detailed calculation.

More than 90% of the taxes you pay throughout your life will come from about a dozen major categories of taxes. For the UK, they are the ones listed further above.

There will be variations for other countries, and with your interest in detail, you will have to work them out yourself. The Daily Telegraph article from 2016 will probably be useful guidance for you. Adapt their approach to what applies to you.

Which option is the most accurate?

Here is what’s fun about this! My rapid option #1 produced the same order of magnitude result as the detailed calculation of the Daily Telegraph:

Option #1: GBP 3.0m

Option #2: GBP 3.6m

It shows that even a rough estimate provides you with a useful first result if you use a suitable methodology.

The more accurate estimate is option #2, because it also includes investment income (which option #1 ignores). However, you will also have to spend between two and three hours of your time.

Given that option #1 will take you no more than 15 minutes, I find it accurate enough to give you some initial guidance. It does show you what order magnitude we are talking about.

It shows that even a rough estimate provides you with a useful first result if you use a suitable methodology.

These are quite chunky numbers.

Are you shocked?

Is it in line with what you would have expected?

Have I piqued your interest to investigate this further?

Where to take it from here?

If you are making a halfway decent amount of money, you will end up paying millions in taxes throughout your lifetime. This holds true even if you are single. For a power couple, you can double the figure. For someone running their own business, it can run into the double-digit millions.

The next question is whether paying so much is justified.

Where does all the money go, and what benefits do you get out of it? Does it serve a greater good? Would you turn yourself into an amoral person if you considered ways and means to lower your lifetime tax bill?

Can you even afford to harp on about morals? Might you be forced to consider alternatives simply because not doing so will leave you struggling until the day you die? (And if you are poor, you will have many years shaved off your life expectancy.)

These are big questions, and in our complex world, there are no short answers.

However, I do find that history often provides us with useful guidance. In part 2 of this series, I’ll provide you with some historical context for:

- How much would your ancestors have paid?

- How can you easily estimate if your government gives you a good deal?

- Which changes can you expect for the 2020s and how do you prepare for them?

Armed with this knowledge, you’ll be superbly prepared for part 3, which will focus on alternative approaches and solutions. Part 2 will be published on Tuesday 21 April 2020, and part 3 on Friday 24 April 2020. Sign up to my email list if you don’t want to miss it.

Three book recommendations

If you want to sharpen your senses for all the hidden and indirect taxes you are paying, there is no better book than “How do I tax thee?” by Kristin Tate. It has a US-centric perspective, but the general notion is just as relevant for anyone living elsewhere. As Kristin succinctly put it: “We do have a unique and pressing responsibility to get informed and stay informed, and to push back against hidden and reckless uses of our money.“

A primer – and not just for Americans!

If you wanted to look at it from a British and higher-level, political perspective, check out “Fleeced! How we’ve been betrayed by the politicians, bureaucrats and bankers and how much they have cost us” by David Craig and Matthew Elliott. As the book says on its cover: “GBP 50,000 taken from every person in Britain“.

German readers could do worse than get a copy of “Das Märchen vom reichen Land – wie die Politik uns ruiniert” by Daniel Stelter. Stelter analyses why Germany (and Germans) live in a wealth illusion, and will soon face their reckoning. The book was published in 2018, but recent events have made it timelier than ever.

If you liked this article, you might also enjoy:

Looking for clever ways to invest your hard-earned cash?

Head over to my investment website Undervalued-Shares.com for common sense investment opportunities from around the world. Ideas that you won’t find anywhere else!

Want to print this article? Open a printer friendly version.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: